Turn of the tide for insurance pricing – home insurance premiums start to drop as cost of car insurance continues to fall

August 13, 2024

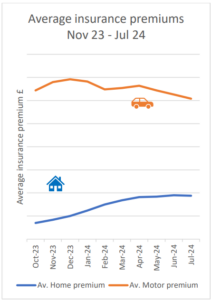

Pearson Ham Group’s latest Premium Price Index for July reveals that home insurance prices have started to reduce for the first time this year, after a prolonged period of climbing and plateauing rates.

While the drop is small at -0.2%, and the impact is limited in that the average home insurance premium now nears £416² which is 29% higher than this time last year, it indicates a significant change in direction for insurance pricing overall. It suggests that home insurance pricing may start to align with motor insurance premiums which have been consistently falling since the first quarter of the year.

However, the reduction in home insurance pricing is not uniform across the UK. Properties in the North West of England saw the largest drop in July at -0.8%, followed closely by homes in Northern Ireland and the North East at -0.7%. These drops are particularly notable as properties in Northern Ireland experienced the largest increase in June with a 1.6% rise, while the North East saw one of the smallest increases in June at 0.3%.

Home insurance pricing movements per region (by magnitude of monthly movement)

|

Region

|

July Movement

|

12-Month Movement

|

|

North West

|

-0.8%

|

32%

|

|

Northern Ireland

|

-0.7%

|

44%

|

|

North East

|

-0.7%

|

31%

|

|

East Midlands

|

-0.6%

|

31%

|

|

West Midlands

|

-0.5%

|

30%

|

|

Wales

|

-0.4%

|

32%

|

|

Yorkshire & the Humber

|

-0.2%

|

31%

|

|

South East

|

-0.1%

|

34%

|

|

London

|

0.1%

|

37%

|

|

Scotland

|

0.1%

|

35%

|

|

East of England

|

0.3%

|

35%

|

|

South West

|

0.4%

|

34%

|

Similarly, by property type, there is a notable variation in the pricing trends observed in July. Semi-detached homes experienced the most significant decrease in home insurance prices at -0.5%, followed by detached houses at -0.3%. Both semi-detached and detached properties also recorded the lowest increases over the preceding two months.

Home insurance pricing movements per property type (by magnitude of monthly movement)

|

Type

|

July Movement

|

12-Month Movement

|

|

House – semi-detached

|

-0.8%

|

32%

|

|

House – detached

|

-0.3%

|

33%

|

|

House – terraced

|

-0.2%

|

33%

|

|

Flat

|

0.7%

|

33%

|

|

Other

|

0.2%

|

38%

|

|

Bungalow

|

0.9%

|

37%

|

Stephen Kennedy, Director at Pearson Ham Group, said:

“These findings mark a significant shift in the home insurance market, offering a glimmer of hope for homeowners and renters across the UK who have faced escalating premiums. While the reduction is modest at -0.2%, it signifies a potential alignment of home insurance pricing trends with those seen in motor insurance, which has been on a consistent decline since the first quarter of the year. This trend could provide much-needed financial relief and stability to policyholders in the coming months.”

Motor insurance premiums

The motor insurance market has experienced ongoing reductions in pricing, with a further -1.5% decrease in June. This decline has led to a 12-month price movement levelling out at insurance premiums now being 3% higher than this time last year, compared to its peak of 47% higher in Q4 2023.

In terms of which regions and segments saw the largest drops in motor insurance pricing, drivers in Yorkshire and the Humber saw an average decrease of -1.9%, followed closely drivers in Northern Ireland which saw an average reduction of -1.8%. By age and vehicle type, drivers aged between 51 to 60 benefitted the most with an average reduction of -1.9% as did owners of vehicles with a value in excess of £20,000 who saw an average drop in insurance pricing of -2.1%

Motor insurance pricing movements per region (by magnitude of monthly movement)

|

Region

|

July Movement

|

12-Month Movement

|

|

Yorkshire & the Humber

|

-1.9%

|

2%

|

|

Northern Ireland

|

-1.8%

|

5%

|

|

Wales

|

-1.7%

|

1%

|

|

North West

|

-1.6%

|

3%

|

|

West Midlands

|

-1.6%

|

4%

|

|

North East

|

-1.5%

|

1%

|

|

South West

|

-1.5%

|

4%

|

|

East Midlands

|

-1.4%

|

3%

|

|

South East

|

-1.4%

|

3%

|

|

London

|

-1.3%

|

2%

|

|

Scotland

|

-1.2%

|

7%

|

|

East of England

|

-1.2%

|

5%

|

Frances Luery, Product Manager at Pearson Ham Group, stated:

“These findings highlight a trend of continued stability in motor insurance pricing, offering much-needed consistency for insurers and policyholders alike. The -1.5% decrease in June and the levelling out of premiums to just 3% higher than last year, down from the peak 47% increase in Q4 2023, signify a more predictable and stable market environment.”